Small-business Credit Quality Improves: Report

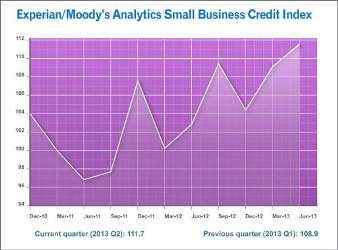

Leading global information services company Experian announced Tuesday that small-business credit conditions strengthened in the second quarter of this year, lifting the Experian/Moody’s Analytics Small Business Credit Index to 111.7 — the highest level since it began tracking in 2010.

According to the latest report, consumer confidence is high and small-business credit quality has shown improvements throughout the quarter due to personal income growth, retail sales increases, and steady employment gains.

“The economy has held up better than anticipated so far this year in the face of large tax increases and government spending cuts, which has supported improved small-business borrowing and credit quality,” said Mark Zandi, chief economist at Moody’s Analytics.

“While there remain several hurdles to even better conditions, including the coming political battles over the Treasury debt ceiling and federal government funding and the prospects for higher interest rates, small businesses should get over these hurdles reasonably well.”

[ Also Visit: Tech-Wise Knowledge Center for SMBs ]Findings from the report showed that small firms have steadily reduced their delinquent debt over the past year. Balance volumes for all business sizes receded measurably from a year earlier, bringing down delinquency rates.

Further, credit quality has strengthened for every business size. At an average of 10.2 percent, the total share of delinquent dollars is 2.4 percentage points lower than it was a year ago and is at the lowest point on record.

“During this period of modest growth, small businesses have improved their credit profile by decreasing delinquent debt and meeting financial obligations in a more timely fashion,” said Joel Pruis, Experian’s senior business consultant.

“Businesses of all sizes need to maintain a strong credit profile, as it enables them to more easily secure the credit or funding they need to grow their enterprise.”

Regionally, the report showed that delinquency rates were significantly lower than the national average for small companies in Idaho, Wyoming, Arizona and Utah.

Additionally, large Western cities, including Phoenix, Ariz.; Houston, Texas; San Francisco, Calif.; Las Vegas, Nev.; San Diego, Calif.; and Salt Lake City, Utah, were all in the top 10th percentile among metro areas for small-business credit quality.

Experian joined forces with Moody’s Analytics, a leading independent provider of economic forecasting, to create a business index and detailed report that provides insight into the health of U.S. businesses.

The Experian/Moody’s Analytics Small Business Credit Index is reported quarterly to show fluctuations in the market and discuss factors that are impacting the business economy.