What Do Americans Want: Debt or Degree?

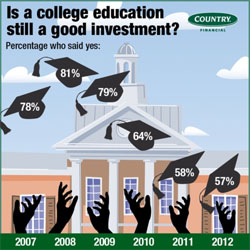

Americans continue to find less value in a college degree. However, they appear to think it’s acceptable to take on more debt to earn one. According to a new COUNTRY Financial Security Index survey, the number of adults who think college is a good investment dropped to 57 percent, down from 81 percent in 2008.

Nevertheless, four in ten (42 percent) said more than $20,000 is an acceptable amount of student loan debt to take on in pursuit of a college degree.

When asked how much student loan debt is too much, Americans were more tolerant of higher loan amounts. The shift suggests people now have a higher threshold for what they consider acceptable student loan debt. This trend might also be because 62 percent prioritized the quality of the education over the cost when evaluating colleges.

“Even with the cost of college rising faster than inflation, a college degree is more valuable than ever. And, an aggressive plan for funding your child’s education can help eliminate the burden of unmanageable student loan debt,” said Joe Buhrmann, manager of financial security support at COUNTRY Financial. “So, start saving early and investigate all your funding avenues and alternative options, such as community college or working part-time.”

[ Also Read: Is America Doing Enough to Create Jobs? ]The cost of obtaining a college degree may be having an impact on both young adults and their parents. Eighty percent of Americans said parents should be responsible for paying at least part of their child’s college education.

A majority (57 percent) say half or less of their child’s college costs will be funded by student loans. Meanwhile, many adults are prioritizing retirement savings (45 percent) over college savings (38 percent).

The COUNTRY survey on college is based on a national telephone and online survey of 3,000 Americans and is compiled by Rasmussen Reports, LLC, an independent research firm. The survey results were released today, July 17.