How to Protect Property from Flood Damage

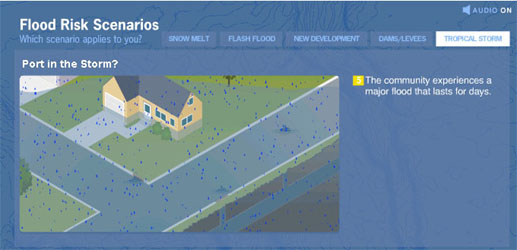

Floods are a year-round hazard, and the risks do not end when cold weather begins. Heavy seasonal rains and snowmelt often lead to flooding during the winter months.

Even areas that receive less snow and rain this winter season might experience drought-like conditions that ultimately can lead to flash flooding when it does rain, warns the Federal Alliance for Safe Homes (FLASH).

It encourages families in the Northwest to understand their unique winter flood risk and prepare now to protect property and possessions from flood damage.

“Winter is the rainy season for the West Coast, and where it can rain it can flood,” said Leslie Chapman-Henderson, FLASH president and CEO. “Because homeowners insurance doesn’t typically cover flood damage, families need to consider purchasing flood insurance now as a standard flood insurance policy typically takes 30 days to go into effect. They should also start now to take measures to protect their homes from costly flood damage.“

Families can take some steps to address these risks. They can visit www.flash.org to find ways to make their homes more resistant to flood damage.

Families also should have an emergency supply kit with items such as non-perishable food, water, and a flashlight with batteries, and a family emergency plan that considers their insurance coverage, especially flood insurance. You can also visit FloodSmart.gov to learn about flood risk and flood insurance.

Flood insurance is available through approximately 85 insurance companies in roughly 21,000 participating communities nationwide (U.S.). Homeowners, renters, and business owners can purchase flood insurance.

Last year, more than 20 percent of all claims paid by the National Flood Insurance Program were for buildings located outside mapped high-risk areas. In these areas, lower-cost Preferred Risk Policies (PRPs) start as low as $129 a year.