How to Mitigate Climate Change: IMF Report

The October 2019 edition of the International Monetary Fund (IMF) Fiscal Monitor focuses on the design of fiscal policies for climate mitigation at the domestic and international level.

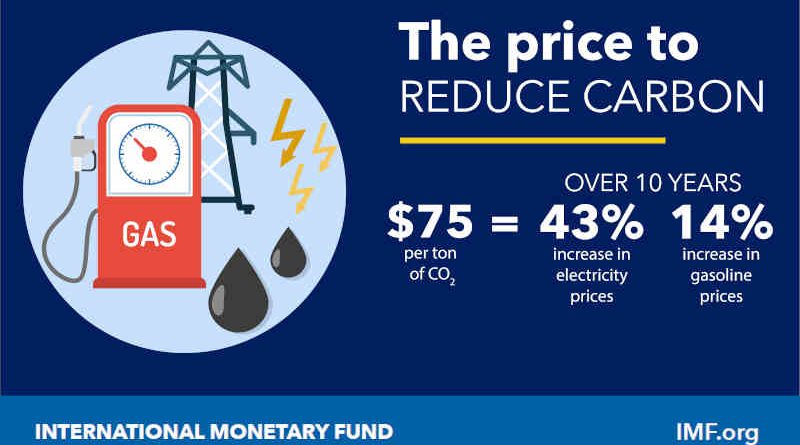

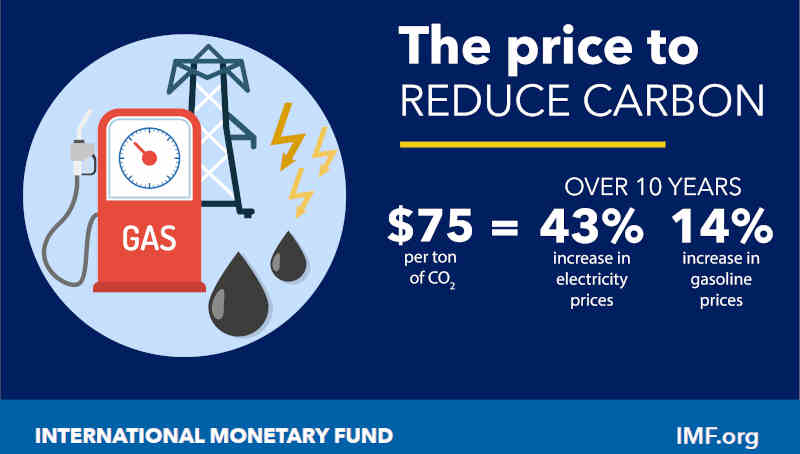

This report emphasizes the environmental, fiscal, economic, and administrative case for using carbon taxes, or similar pricing schemes such as emission trading systems, to implement climate mitigation strategies.

It provides a quantitative framework for understanding their effects and trade-offs with other instruments and applies it to the largest advanced and emerging economies. Alternative approaches, like “feebates” to impose fees on high polluters and give rebates to cleaner energy users, can play an important role when higher energy prices are difficult politically.

| Download All Issues of Clean Climate News Magazine | ||

| November 2018 | December 2018 | January 2019 |

| February 2019 | March 2019 | April 2019 |

| May 2019 | June 2019 | July 2019 |

| August 2019 | September 2019 | October 2019 |

At the international level, the report calls for a carbon price floor arrangement among large emitters, designed flexibly to accommodate equity considerations and constraints on national policies.

The report also estimates the consequences of carbon pricing and redistribution of its revenues for inequality across households. Strategies for enhancing the political acceptability of carbon pricing are discussed, along with supporting measures to promote clean technology investments.