UN Chief Welcomes Steps to Address Debt Crises from Covid Pandemic

The UN Secretary-General called on all stakeholders to join in a global effort to rethink the principles underpinning today’s debt architecture.

In a statement issued on April 9, UN Secretary-General António Guterres welcomed the steps announced by the International Monetary and Finance Committee (IMFC) and the World Bank Group Development Committee to address debt crises and other damage arising from the Covid-19 crisis as a sign of hope and renewed multilateralism.

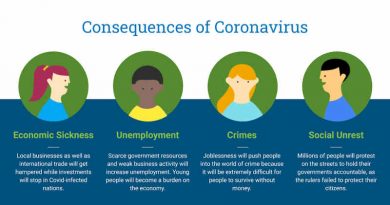

Developing economies have struggled to secure enough financial resources to respond to the immediate needs of the crisis – let alone to recover from it. Since the beginning of the crisis, the Secretary-General has called for liquidity through a large issuance of Special Drawing Rights (SDRs) and a reallocation of unutilized SDRs. He has proposed a three-phased approach to address debt burdens: a debt standstill, targeted debt relief for the most vulnerable, and a reform of the international debt architecture.

In his statement, the Secretary-General welcomed the IMFC’s concrete calls for a new allocation of SDRs and voluntary reallocations to countries in need. He is also encouraged by the support for the Debt Service Suspension Initiative (DSSI), which has provided $5 billion in temporary relief for vulnerable countries, and for the Common Framework for Debt Treatments.

Debt standstills and relief must be extended to countries that need it most – including middle-income countries, which are home to more than 60 percent of the world’s poor – without creating stigma or compromising their sovereign ratings.

Reforming the international debt architecture is also critical; a debt crisis amidst the Covid-19 emergency would put the Sustainable Development Goals out of reach. The ongoing discussions on international debt architecture are a major step in the right direction, Mr. Guterres said.

He called on all stakeholders to join in a global effort to rethink the principles underpinning today’s debt architecture, and urges action to complement existing instruments with more effective debt crisis resolution mechanisms.

The Secretary-General said he is also encouraged by the IMF’s and World Bank’s emphasis on a sustainable, inclusive, smart and green recovery.

The statement added that he looks forward to working with the international financial institutions, multinational and national development banks and other partners towards an equitable, inclusive and sustainable recovery that places the world on track to achieve the Sustainable Development Goals.