Age Won’t Stop Them from Working: Survey

The traditional concept of retirement is being rejected by a new breed of wealthy workers who want to carry on working for as long as they are able, says Barclays Wealth in its latest Insights report, The Age Illusion: How the Wealthy are Redefining Their Retirement.

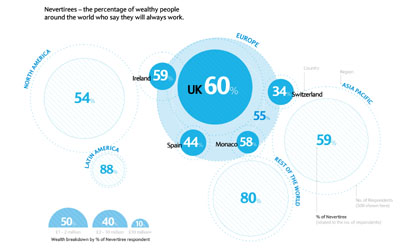

It says 60% of UK wealthy individuals polled in the survey say that they plan to become a Nevertiree, shunning traditional retirement and instead continuing to work, start businesses and take on new projects in their later years.

Also Read:

Can Technology Help You Slow Up Skin Aging?

Outsourcing: Latin America Threat to India, China

Why Locals are Hostile against Immigrants

Need to Change 5 Old Rules at Workplace

Skilled Workers Shortage Can Hamper Growth

10 Things Workers Want to See on Social Media

The report, the twelfth in the Barclays Wealth Insights series, is based on a global survey of 2,000 high net worth individuals globally, who were asked to consider what retirement and later life means to them.

The findings show that the concept of Nevertirement is expected to become more popular over the coming years, with 70% of respondents under the age of 45 saying that they will always be involved in some form of work.

Whilst a desire to remain in work might be expected to chime with business owners and entrepreneurs, the findings apply to all wealthy respondents, with 57% of those who inherited their wealth saying they too will continue working in later life.

Although the emerging markets show the biggest desire to keep on working in later life, the UK leads the way amongst the developed economies.

In the US, 54% of respondents expressed a desire to carry on working, with Switzerland (34%), Spain (44%) and Japan (46%) more likely to opt for a conventional retirement.

The top 5 ‘Nevertiree’ countries in Europe on the basis of percentage of respondents who envisage themselves always being involved in some form of commercial/professional work are: UK (60%), Ireland (59%), Monaco (58%), Spain (44%), and Switzerland (34%).

Rather than look to later life as a time of leisure or years of old-age, 77% of Nevertirees view this period as ‘just another phase of their life’, suggesting that the traditional retirement age no longer marks any significant milestone in terms of their general lifestyle.

However, the report finds as well as wanting to keep on working, the wealthy are using the later years to re-examine their options with regards to work, looking for different careers and positions, often moving from the role of execution and control to that of influence.

Sarah Harper, professor of Gerontology and director of the Oxford Institute of Ageing at the University of Oxford, says, “People want to contribute, they want to be doing something. Work gives people status, and at an age when you’re incredibly experienced you may want to start a second career or even do something completely different from your previous professional life.”

The report cautions that continuing to work could mean that important succession issues remain unresolved, as the wealthy continue to put their efforts into working life.

With only half (51%) stating that they feel financially responsible for their children and when asked if they wish to leave a sizeable amount of wealth to their family, the UK is one of the countries least likely to do so, with just over a third (35%) saying they will not pass on their wealth. This is despite the same proportion of respondents saying that their children will be less wealthy than them.

Barclays Wealth is a leading global wealth manager. With offices in over 20 countries, it focuses on private and intermediary clients worldwide, providing international and private banking, investment management, fiduciary services and brokerage.

Researched by Ledbury Research and written in conjunction with Barclays Wealth, this 12th volume of Barclays Wealth Insights looks at the changing attitudes towards retirement and succession planning amongst the global high net worth community.

It is based on two main strands of research. Firstly, Ledbury Research conducted a survey of more than 2,000 high net worth individuals, all of whom had over GBP1m (or equivalent) in investable assets and 200 with more than GBP10m.

Respondents were drawn from 20 countries around the world, across Europe, North America, South America, Middle East and Asia Pacific. The interviews took place during the first half of 2010.

Secondly, Ledbury Research conducted a series of interviews with academics, entrepreneurs and other experts from around the world.

The findings of the report were released Sunday, Sept. 26.