Hindenburg Accuses SEBI Chief of Collusion in Adani Money Laundering Scandal

Hindenburg Accuses SEBI Chief of Collusion in Adani Money Laundering Scandal

Instead of investigating the enormity of fraud in the Adani case, the SEBI preferred to intimidate Hindenburg with legal action.

By Rakesh Raman

Hindenburg Research – which is a U.S. investment research firm – has accused the Securities and Exchange Board of India (SEBI) chairman Madhabi Puri Buch and her husband Dhaval Buch of complicity in one of the most heinous corporate fraud scandals.

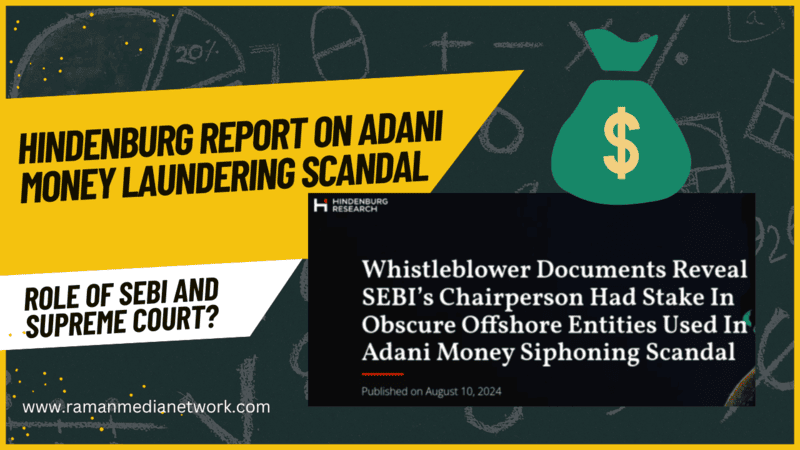

In a report published on August 10, 2024, Hindenburg Research claimed that the SEBI chief had a stake in obscure offshore entities used in the Adani money siphoning scandal.

Earlier, in its investigative report released on January 24, 2023, Hindenburg Research said that the Adani Group and its chairman Gautam Adani have engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades. The report accused Adani of commiting one of the biggest corporate frauds in the world.

In its latest report, Hindenburg has quoted whistleblower documents to reveal that SEBI – which was supposed to investigate the Adani scam case – has shown little interest to explore Adani’s alleged undisclosed web of offshore shell entities in Mauritius or other places.

Hindenburg states that its January 2023 report exposed a web of offshore – primarily Mauritius-based – shell entities used for suspected billions of dollars of undisclosed related party transactions, undisclosed investment and stock manipulation by the Adani Group. It also said that the Adani Group was operating “the largest con in corporate history”.

Since then, according to Hindenburg, despite the evidence, along with over 40 independent media investigations corroborating and expanding on its original work, Indian securities regulator SEBI has taken no public action against the Adani Group.

Hindenburg suspects that SEBI is likely to impose mere token, technical violations on the Adani Group despite the breadth and magnitude of the issues.

Instead of investigating the enormity of fraud in the Adani case, the SEBI preferred to intimidate Hindenburg with legal action. On June 27, 2024, SEBI sent Hindenburg a vague ‘show cause’ notice, which according to Hindenburg, did not allege any factual error in its report.

In its July 2024 response to the ‘show cause’ notice, Hindenburg found it odd how SEBI—a regulator specifically set up to prevent fraudulent practices – showed little interest in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through a network of sham investment entities.

In its original Adani report, Hindenburg cites documents from the Directorate of Revenue Intelligence (DRI) which alleged that Adani “grossly” overvalued the import valuation of key power equipment, using offshore shell entities to siphon and launder money from the Indian public.

Hindenburg adds that a subsequent investigation by non-profit project Adani Watch in December 2023 showed how a web of offshore entities, controlled by Gautam Adani’s brother, Vinod Adani, were recipients of funds from the alleged over-invoicing of power equipment.

In one complex structure, according to Hindenburg, a Vinod Adani controlled company had invested in “Global Dynamic Opportunities Fund” (“GDOF”) in Bermuda, a British overseas territory and tax haven, which then invested in IPE Plus Fund 1, a fund registered in Mauritius, another tax haven.

Whistleblower documents obtained by Hindenburg show that Madhabi Buch, the current chairperson of SEBI, and her husband had stakes in both obscure offshore funds used in the Adani scandal.

[ Video: अदानी ग्रुप पर नई हिंडनबर्ग रिसर्च रिपोर्ट।सरल शब्दों में जानें अडानी मनी लॉन्ड्रिंग केस ]

“We had previously noted Adani’s total confidence in continuing to operate without the risk of serious regulatory intervention, suggesting that this may be explained through Adani’s relationship with SEBI chairperson, Madhabi Buch,” Hindenburg said in its latest report.

“What we hadn’t realized: the current SEBI chairperson and her husband, Dhaval Buch, had hidden stakes in the exact same obscure offshore Bermuda and Mauritius funds, found in the same complex nested structure, used by Vinod Adani,” Hindenburg adds.

According to Hindenburg, Madhabi Buch and her husband Dhaval Buch first appear to have opened their account with IPE Plus Fund 1 on June 5, 2015 in Singapore, per whistleblower documents.

A declaration of funds, signed by a principal at IIFL states that the source of the investment is “salary” and the couple’s net worth is estimated at $10 million, Hindenburg states.

In a vaguely written statement issued on August 11, 2024, SEBI chairman Madhabi Puri Buch and her husband Dhaval Buch called it an attempted “character assassination” by Hindenburg in response to SEBI action. However, this statement does not refute any of the accusations made by Hindenburg in its reports.

With a standard statement, the Adani Group on August 11 also rejected the latest report by Hindenburg Research as “recycled claims”.

SUPREME COURT ROLE IN ADANI MONEY LAUNDERING CASE

As the Supreme Court of India has become a toothless outfit, it has failed once again to deliver justice in the money laundering and accounting fraud case of the Adani Group.

In its judgment of January 3, 2024, a Supreme Court bench headed by Chief Justice of India D. Y. Chandrachud said there were no grounds to transfer the probe to a special investigation team (SIT).

The court relied on the opaque and sketchy investigation conducted by the Securities and Exchange Board of India (SEBI) which – like the Supreme Court – is a complicit organization trying to exonerate the Adani Group and its chairman Gautam Adani.

It was reported in January 2024 that SEBI had investigated 22 of the 24 cases in the Adani case and the Supreme Court had given it three more months to complete the investigation. But so far the SEBI probe findings have not been made public.

In his tweet on January 3, 2024, Gautam Adani celebrated the Supreme Court decision with his remarks, “Truth has prevailed. Satyameva Jayate” with the apparent indication that he has been exonerated in the case.

But oligarch Gautam Adani did not mention that the Supreme Court and other law-enforcement agencies are protecting him unscrupulously because he is a partner of India’s prime minister (PM) Narendra Modi who himself is allegedly involved in a number of corruption cases.

These cases include the PM-CARES Fund case, Rafale corruption case, Sri Lanka energy project case involving Adani Group, Modi-Adani collusion case, Sahara-Birla payoff case, and a number of other cases in which Modi’s party colleagues are allegedly involved.

In fact, the Modi-Adani collusion case is termed as the Modani (portmanteau for Modi and Adani) corruption scandal, which is perhaps the biggest grand corruption crime in the history of mankind.

In this case, it is alleged that Gautam Adani colluded with Modi for about two decades to plunder India’s public assets. Since the Indian courts, law-enforcement agencies, and media houses cannot dare to investigate or report about the Modi-Adani collusion case honestly, some foreign publications have been covering the stories of this corruption scandal involving billions of dollars.

Surprisingly, however, the Supreme Court ignored all the investigative reports of credible media organizations and acquitted Adani and his allegedly illicit businesses without holding a fair and transparent investigation.

In the past when Modi or his associates were accused in such cases, the Supreme Court took questionable decisions to favour Modi or formed perfunctory committees which could not dare to point the finger at Modi or his friends.

It has happened in cases such as the Rafale corruption case, Gujarat massacre case, Article 370 case of Kashmir, Pegasus spyware case, draconian demonetization decision of Modi, cases of farmers’ protests, case of PM-CARES Fund of PM Modi, electronic voting machine (EVM) fraud case, the mysterious death case of Judge Loya (Brij Gopal Hari Kishan Loya), and many others.

Now it appears that the Supreme Court has become the Godi court (or lapdog court) of the Modi regime. The Supreme Court judges are either scared of the Modi regime or corrupt who want plum positions after their retirement. That is why they fail to deliver justice.

[ You can click here to download and read “India Judicial Research Report 2024: Decline of the Indian Judiciary” to know the corruption and complicity of Indian courts. ]

While Adani is accused of a serious financial crime, the Supreme Court is trying to brush the case under the carpet with the formation of toothless committees or with the perfunctory probe by SEBI which cannot file any report that can get Adani prosecuted and convicted.

In all probability, the findings of the SEBI report will not be made public and Adani will be acquitted of all the charges. Subsequently, Adani, Modi, and Modi’s colleagues will silence the opposition voices by saying that the Supreme Court has found that Adani is honest and no fraud has happened in this case.

If you evaluate the judgments of the Supreme Court through an Artificial Intelligence (AI)-based expert system, you will find that almost all the judgments, dismissal of petitions, or delays in decisions are either wrong or biased in favour of the Modi regime.

WEAK OPPOSITION

When the opposition leaders questioned Modi in the parliament on the Modi government’s complicity in the Adani fraud, Modi did not even touch the Adani issue. Rather, he delivered a long rhetoric to praise himself and baselessly accuse the opposition party Congress of corruption. After some feeble protests, Congress did not pursue the Adani case.

In fact, it is a clear case of grand corruption and money laundering for which Adani or his associates should have been taken into custody for proper investigation. The Hindenburg report states that Adani’s frauds included the formation of offshore shell entities to generate artificial turnover and money laundering.

But the SEBI and other law-enforcement agencies turned a blind eye to this alleged fraud and never tried to reveal the information publicly about these shell entities and the money laundered through them because Adani is a close friend of Modi.

The Financial Action Task Force (FATF), which sets global standards on beneficial ownership transparency, had agreed in March 2022 for tougher global beneficial ownership rules to stop criminals from hiding their illicit activities and dirty money behind secret corporate structures.

But the Indian agencies have deliberately ignored the FATF rules on beneficial ownership and did not publicly release the real beneficial ownership registers of Adani Group entities. It is possible that the dirty money is being used to support the terrorist financing activities that FATF is supposed to monitor.

Such reports are already coming. A March 2, 2023 media report reveals that an entity related to the Adani Group financially supported a company that violated sanctions imposed by the United Nations Security Council (UNSC) on trade with North Korea.

According to the report, the sanctioned company was owned by sons of Chang Chung-Ling, an Adani Group associate who appeared in the Hindenburg report for his directorship of Adani entities.

Actually, the committee formed by the Supreme Court, SEBI, and other law-enforcement agencies should have investigated all such allegations and live-streamed their interaction with the accused involved in this case.

The investigating agencies should also reveal if the corruption money made in the Rafale deal or the PM-CARES Fund has been invested in the Adani Group, as these cases have never been probed thoroughly.

Since the Supreme Court committee, SEBI, and the other law-enforcement agencies such as the Enforcement Directorate (ED) or the Central Bureau of Investigation (CBI) are not expected to act honestly, the Adani case should be prosecuted in international forums outside India.

The U.S., for example, can treat this case of significant corruption under Section 7031(c) of the annual Department of State, Foreign Operations, and Related Programs Appropriations Act or the Global Magnitsky sanctions program. Similarly, the UK can prosecute it under the UK Global Anti-Corruption Sanctions Regime.

Finally, the Modi-Adani case of grand corruption should be prosecuted in the International Anti-Corruption Court (IACC) proposed by Integrity Initiatives International and Club de Madrid, which is a group led by former democratic Presidents and Prime Ministers from around the world.

By Rakesh Raman, who is a national award-winning journalist and social activist. He is the founder of a humanitarian organization RMN Foundation which is working in diverse areas to help the disadvantaged and distressed people in the society.