How Money Mules Use Internet to Commit Frauds

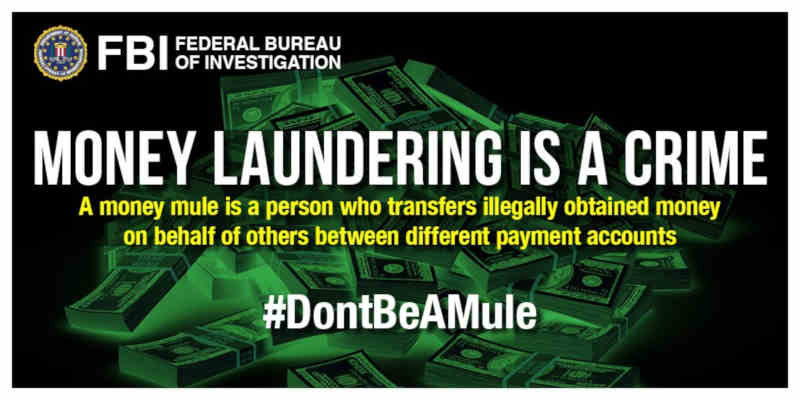

The FBI has joined with law enforcement partners worldwide to raise awareness of and curtail this illegal movement of funds, which is fueling the growth of crimes across the globe.

The FBI defines a ‘money mule’ as a person who transfers illegally acquired money on behalf of or at the direction of another. Money mules often receive a commission for the service or provide assistance because they believe they have a trusting or romantic relationship with the individual who is asking for help.

Much of the money moved through these third-parties is stolen through Internet-enabled frauds, thefts, and scams. Drug trafficking and human trafficking are also common sources of the money. While some money mules may be genuinely unaware of their involvement in a larger criminal scheme, many fully understand they are moving money attained from unlawful activities. All mules, whether unaware or complicit, are committing a crime.

| Download and Read RMN Publications | ||

| TechWise Today | The Integrity Bulletin | Clean Climate |

| Legal Directions | Young Learner | Real Voter |

“Money mules are needed to help move stolen money from country to country, avert the scrutiny of financial institutions, and mask the identity of the individuals involved in these largely Internet-enabled crimes,” said Special Agent James Abbott of the Bureau’s Money Laundering, Forfeiture, and Bank Fraud Unit at FBI Headquarters. “Being able to easily move the profits from these crimes contributes to their rapid growth and threatens the safety and security of everyone who has a presence online.”

The FBI says it recently conducted more than 300 interviews with individuals who had been flagged by financial institutions for activity that indicated they were acting as money mules. The stories they relayed to FBI agents help draw a picture of how these individuals, who span every race, gender, and age demographic, are recruited and used.

Courtesy: FBI