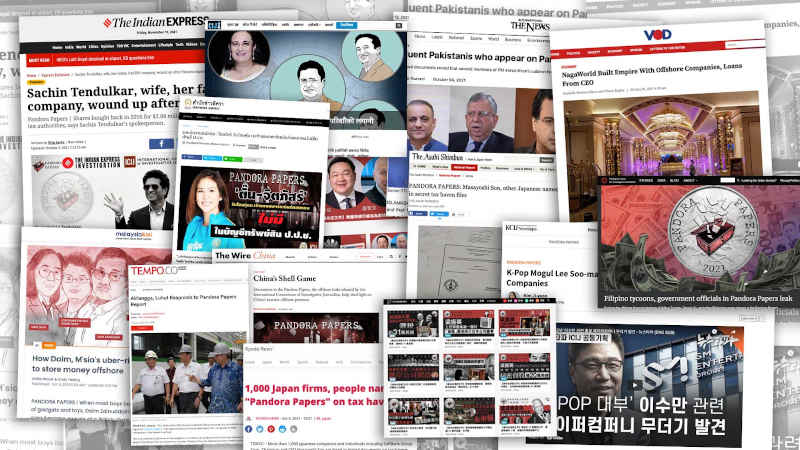

Pandora Papers Identify 300 Indians with Offshore Accounts

Pandora Papers reveal how the rich, the famous and the notorious set up complex multi-layered trust structures for estate planning.

The Indian Express has identified more than 300 Indians with offshore accounts in the leaked data, including Bollywood celebrities, industrialists, people accused of fraud and other financial crimes, as well as famous sports stars like Sachin Tendulkar.

According to its report published on November 23, the worldwide investigation led by the International Consortium of Investigative Journalists (ICIJ) was based on 11.9 million confidential records leaked from 14 offshore financial service providers that help wealthy clients set up shell companies and trusts in a variety of tax havens, including Seychelles and Dubai. Two of the providers, Asiaciti Trust and Il Shin, are based in the Asian financial hubs of Singapore and Hong Kong, respectively.

“What our investigation into the Pandora Papers has revealed is the brazenness with which many of the subjects we are writing about went about setting up offshore entities, despite the reforms in the offshore sector,” said Ritu Sarin, investigations editor at The Indian Express, an ICIJ partner.

Two former officers of the Indian Revenue Service, one who was arrested for alleged corruption and money laundering, and another who was an Income Tax Chief Commissioner, were found to have Swiss bank accounts, The Indian Express reported. Soon after the revelations, according to ICIJ, India’s finance ministry announced it will investigate the Indian names exposed in the leak and take “appropriate action.”

According to The Indian Express, Pandora Papers reveal how the rich, the famous and the notorious, many of whom were already on the radar of investigative agencies, set up complex multi-layered trust structures for estate planning, in jurisdictions which are loosely regulated for tax purposes, but characterised by air-tight secrecy laws.