Small Businesses Plan Hiring: Financial Survey

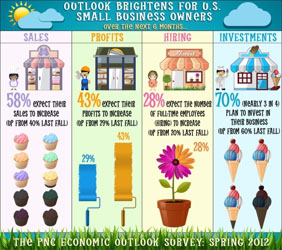

An upbeat outlook on sales will prompt nearly one in three U.S. small business owners to add employees over the next six months as their optimism returns to positive levels unseen since before the ‘Great Recession’ of 2008-2009, according to the PNC Economic Outlook survey’s newest findings.

The spring findings of PNC’s biannual survey, which began in 2003, show expectations for sales and profits have rebounded from near-historic lows last fall and that owners have growing optimism about the U.S. economy, and their own company’s prospects. Nearly three in four (70 percent) plan to invest in their business in the next six months, according to the survey.

Despite the good news, inflation expectations remain elevated, as two in five owners (40 percent) plan to raise their selling prices, while only 7 percent intend to cut prices, indicating a significant rise in pricing pressures. Two-thirds (69 percent) plan to increase prices by more than 2 percent, which is Federal Reserve’s inflation “goal.”

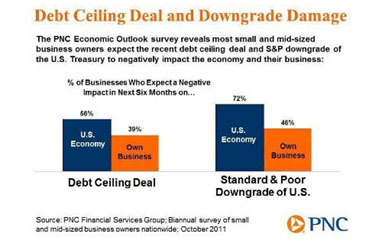

Just six months ago, in October 2011, PNC Economic Outlook survey had stated that with weak sales as a major challenge, four out of five U.S. small business owners will maintain or reduce their number of full-time employees over the next six months, and they see little value in proposed Federal incentives to create jobs. (Read: U.S. Small Business Owners Dismiss Hiring Incentives)

[ Meanwhile, our site RMN Digital has launched Tech-Wise Knowledge Center for SMBs to educate small and medium businesses (SMBs) across the world on the finer nuances of technology selection, adoption, and management. ]“With the start of the baseball season, the economic recovery is on base, but heading home, but rising energy prices, elevated unemployment and a recession in Europe could still prevent it from scoring the winning run,” said Stuart Hoffman, chief economist at PNC.

“These findings show a significant improvement in business expectations and optimism, and thus strongly support PNC’s baseline forecast that the U.S. economic and jobs recovery will continue to play ball in 2012-2013.”

[ Also Read: Can Obama Jobs Plan Reduce Poverty in America? ]The survey, which gauges the mood and sentiment of small and medium sized business owners, found that nearly six in 10 (58 percent) expect their sales to increase in the next six months, up sharply from last fall (40 percent).

Just 10 percent expect them to decrease, which is significantly lower than last fall (20 percent). Profits are also on the rebound, as 43 percent expect an increase compared to 29 percent in the fall.

The PNC Economic Outlook survey was conducted between Jan. 25 to February 17, 2012, by telephone within the United States among 1,697 owners or senior decision-makers of small and mid-sized businesses with annual revenues of $100,000 to $250 million. The survey findings were released Thursday, April 5.

The PNC Financial Services Group, Inc. is a diversified financial services organizations providing retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management.