Trump Presidency Favorable for Stock Market: Survey

In a recent survey of self-directed, independent investors, the majority of respondents gave Donald Trump a narrow lead over Hillary Clinton when asked which U.S. presidential candidate had the potential to most favorably impact the U.S. stock market.

Trump garnered 39% of responses while Secretary Clinton received 34%, followed by John Kasich with 13%, Ted Cruz with 9% and Bernie Sanders with 4%.

Investors surveyed described themselves as predominantly neutral to bearish on the market near-term, while they watch oil prices, interest rates and earnings.

[ Muslims Angry Over Trump’s Use of ‘Pig’s Blood’ Myth ]

The in-house survey of 550 independent investors was conducted April 26 – May 2, 2016 by TradeKing Group, Inc. The survey results were announced Wednesday.

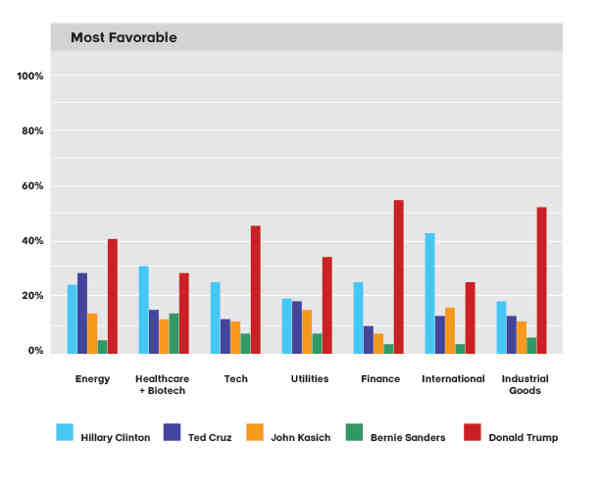

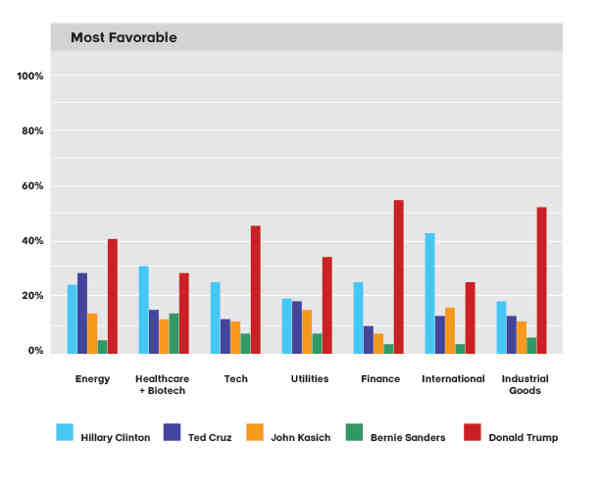

The survey further asked investors to pick the presidential candidate with the most potential to favorably impact key industry stock sectors.

Trump received the highest favorability for the energy, technology, utilities, finance and industrial goods sectors. Secretary Clinton received the highest favorability for the healthcare / biotech and international sectors.

Other Survey Highlights:

Split-Decision on Market Outlook

Nearly half of all respondents (47%) described their market outlook as neither “bullish” nor “bearish,” but rather “neutral” for the next three months. Most of the remaining responses were split nearly evenly: 25% “bearish” and 28% “bullish.”

A year ago, the TradeKing survey revealed a dramatically different sentiment, when 44% of respondents categorized themselves as “bullish.” By November of 2015, that number dropped sharply to 21% heading into year end and what proved to be a rough start to the market in January.

Longer-term Optimism

While respondents were pessimistic about the coming three months, optimism reigned over the longer term. When asked where they expect the S&P 500 will be trading by year’s end, 45% believe it will be up at least 5 – 10%, 29% believe it will be flat and 26% believe it will be down at least 5-10%.

Q3 Interest Rate Hike Deemed Most Likely

Most investors surveyed don’t envision the Federal Reserve raising interest rates before July 2016. Most (34%) see rates likely to increase in Q3 ’16, with 21% see increases coming in Q4 ’16 and 31% believing there will be no interest rate increase in 2016 at all.

Top Trade Triggers

Oil tops the list of trade triggers at 57%, followed by Interest Rates at 43% and Quarterly Earnings at 35%.

Sector with Most Near-Term Potential

The energy sector was deemed by investors the sector with the most potential for opportunity in the next three months, followed by healthcare and technology. Which sectors do investors see having the least potential? Telcom and retail.

TradeKing Group, Inc. consists of companies with their focus on helping the independent investor succeed.