Homeowners Challenge Their Property Taxes

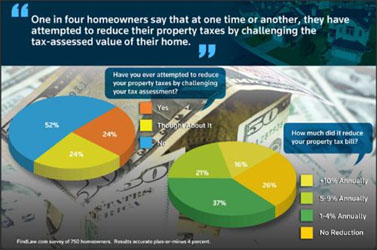

Some homeowners are taking matters into their own hands when it comes to their property tax bills. One in four homeowners say that at one time or another, they have attempted to reduce their property taxes by challenging the tax-assessed value of their homes.

And the majority who did so say that they were successful in lowering their tax bills. That’s according to a new nationwide survey by FindLaw.com, a legal information website.

As home values have declined as a result of the housing crisis, some homeowners feel that the tax-assessed value of their homes – which is the basis for calculating their property taxes – may not accurately reflect actual market conditions.

Homeowners may file an appeal or challenge with their local tax authority in hopes of reducing their assessments, and in turn, their property tax bills.

According to the survey, 24 percent of homeowners say they have challenged their assessments at some point during their home ownership. When a challenge was filed, survey respondents said it was successful in lowering their property tax bills in approximately three-quarters of those instances.

Most often, the net reduction in their annual property tax bills was between 1 and 4 percent.

“It’s not enough to simply march into the tax assessor’s office and say, ‘I think my property taxes are too high,'” said Stephanie Rahlfs, an attorney and editor with FindLaw.com.

“Challenging an assessment requires research and due diligence. A challenge needs to be presented with a well-researched and well-organized set of facts. In addition, the formulas for calculating property taxes and the procedures for appeals can vary widely depending on the county and state.”

The FindLaw survey was conducted using a survey of a demographically balanced sample of 750 American adult homeowners and has a margin of error of plus-or-minus 4 percent.

The survey results were announced Thursday, July 21.

💛 Support Independent Journalism

If you find RMN News useful, please consider supporting us.