Will Social Security Retirement Age Rise to 80?

Four in ten Americans, or 39 percent, say that by 2036 the retirement age will jump to age 80, according to a new survey commissioned by Engage America for its new Social InSecurity Project and conducted by GfK Roper Public Affairs, a division of GfK Custom Research North America.

This finding illustrates that many Americans think Social Security will not exist in its current form when they retire. In fact, the Social Security Administration reports that by 2036 they will not have enough cash to pay promised benefits.

[ Also Read: Can Obama Jobs Plan Reduce Poverty in America? ]Social Security is under threat as Americans live longer and the number of citizens reaching retirement age grows. Unless changes are enacted, retired Americans as of 2036 will receive only 77 percent of the payouts promised.

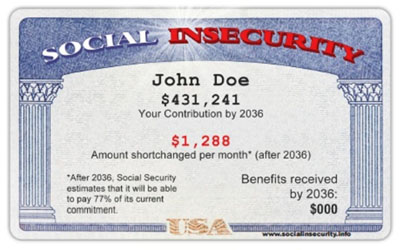

To help Americans personalize the impact of this shortfall, Engage America has created a Social InSecurity Calculator. By entering age, gender and current income (or using median income), the Calculator displays the following on a Social InSecurity card that can be printed out:

- A dollar estimate of how much money individuals and their employers will contribute to Social Security by 2036;

- The estimated gap (in 2036 dollars) in what Social Security promises to pay versus what it will actually be able to pay in 2036.

So, the public can calculate their Social Security contributions and grasp how they might be shortchanged. The numbers are grim for those under 50.

[ Also Read: Nine Signs You’re Working in a Sick Company ]On the web site, the public can vote on a range of solutions to make Social Security solvent for the long term that will not require Americans to continue working until age 80. Engage America will leverage the results to advocate for change.

Social Security is a solvable issue that, if resolved, can serve to break the impasse in Washington and kick-start change. By making modest adjustments now, drastic future corrections can be avoided.

[ Also Read: Need to Change 5 Old Rules at Workplace ]“The survey shows the widespread worry that Social Security won’t be there for Americans under 50,” said Lynnette Khalfani-Cox, The Money Coach. Lynnette, a personal finance expert, has partnered with Engage America to raise awareness of the Social Security shortfall.

“Nearly half of Americans under 50 feel that the retirement age will climb to 80. The Calculator helps people understand how this will affect them so they will be motivated to voice their concerns and encourage our leaders to take action,” adds Khalfani-Cox.

[ Also Visit: RMN Content and Communications Services ]The survey also revealed that 63 percent of respondents do not believe that in 2036 Social Security “will remain fully funded and operate basically as it does today,” and 37 percent think Social Security “will cease to exist.”

Despite the financial crisis, Social Security is fixable. Engage America is working to bring this issue to the public’s consciousness and advocate for a balanced solution. From expansion of payroll tax revenues to an increase in the retirement age, a range of solutions exist, but they must be acted upon now, it says.

The results contained in the report are based on interviews conducted from October 28-30, 2011. A total of 1,000 interviews were completed with approximately 500 female adults and 500 male adults. The survey results were announced Tuesday, Dec. 13.

Engage America is a non-profit organization dedicated to rekindling the dream in which American prosperity and the common good are realized through well-reasoned policies. The organization uses social media to deliver fact-based, research driven messages about core national issues.